Proven Strategy for DIY Trend & Momentum Trading

Dive into an actionable trading strategy as disclosed by a senior retail trader, compelled to empower your DIY trend & momentum trading journey. No hype, no scams – we don’t run on FOMO.

Got laid off? Behind on retirement savings? Transition from haphazardly picking stocks to a methodical approach to identify value and growth gems of quality. But no, trading will most likely not make you financially independent. However, it can still contribute to your coin bucket with enviable returns!

The overall market trend will have a significant impact on the performance of most portfolios. We are active in a bull market and reluctant during a correction and bear market. There is no need for us to be in the market on stormy weeks.

THIS SITE IS STILL UNDER CONSTRUCTION. Accounts and other features are not fully functional.

Our Trend and Momentum Strategy advances over four sequential Domains

The Magic of Screening

We do not suggest or recommend stocks for you. Knowing how to hunt for prospective stars will be your edge. It starts with screening trending sectors and industries for momentum. The premise is that surging stocks are driving these industries to rise. As a DIY trader, you then identify these most opportune quality stocks in rising sector/industry groups, based on descriptives, fundamentals, and technicals.

No hype, no FOMO. Are You A DIY Trader?

Visa, Mastercard, PayPal

What’s in a Screen?

Screening stocks is one of those game-changers that saves you from endless scrolling through thousands of tickers. Essentially, it’s like applying a filter to a vast list of stocks, allowing you to zero in on those that align with your preferences or strategy.

Quick Breakdown:

- What it is: You set up criteria (think price, earnings growth, dividend yield, sector, etc.) and run a “screen” to spit out a shortlist of stocks that fit. No more guessing—it’s data-driven hunting.

- Why bother?: As retail folks, we’re not institutional whales with armies of analysts. Screening helps identify hidden gems, such as undervalued plays or high-momentum runners, ideally before the crowd piles in. It significantly reduces research time.

- How it works in practice:

- Pick a tool: Screening platforms, like Finviz, are gold for ordinary traders. We use a free account on Finviz.

- Choose filters: E.g., market cap > $1B (to avoid microcaps if you’re risk-averse), P/E under 15 (value hunt), and volume > 1M shares (for liquidity).

- Run it: Boom—get a table of results. Then dive deeper with news or charts.

Start simple—maybe screen for your top 3 must-haves—and tweak as you learn. It’s not foolproof (markets are wild), but it’s way better than FOMO-buying.

However, let’s face it: screening options on online platforms, even on Finviz, can be bewildering. Who understands all these parameters without a Ph.D. in economics or finance? There is a solution.

Our ready-to-purchase screens offer convenient, best-in-class values for approximately a dozen key parameters (filters), as well as a few vital ones. More is not always better. Our screens are designed for novice DIY trend and momentum traders, are customizable, and can be applied to most trading platforms. These blueprint screens save busy folks like you precious time and improve your decision-making.

However, screens alone are no silver bullet. The stock market is crowded with traders of all walks of life running screens and then some. Low-hanging fruits are quickly taken, even the unripe ones. The stock market requires your best.

Need-To-Know Blog

-

Concise Guide To Basic Order Types And Their Use Cases

We urge you to use stop orders to protect your assets. Use…

-

Building Better Focus: The End of FOMO

Have you ever been taken by FOMO, the fear of missing out?…

-

3 No-Code Algo Tricks To Fill Your CoinBucket

We’ve been zeroing in on nuts-and-bolts algos that actually generate profits without…

-

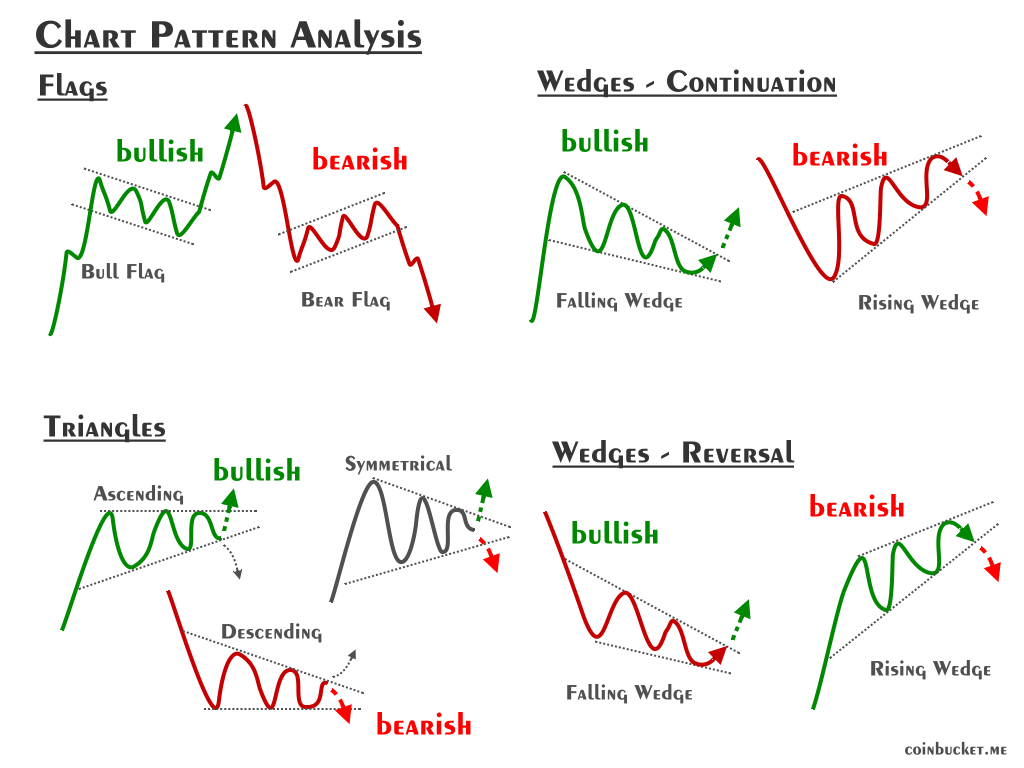

Getting started with Chart Patterns: Spot High-Probability Setups And Dodge the Traps

We’ll break down four battle-tested ones: two pure trend chasers and two…

-

How To Use Volume Confirmation To Avoid Traps & And Stay Profitable

Volume confirmation—it’s that secret sauce that separates the real breakouts from the…

-

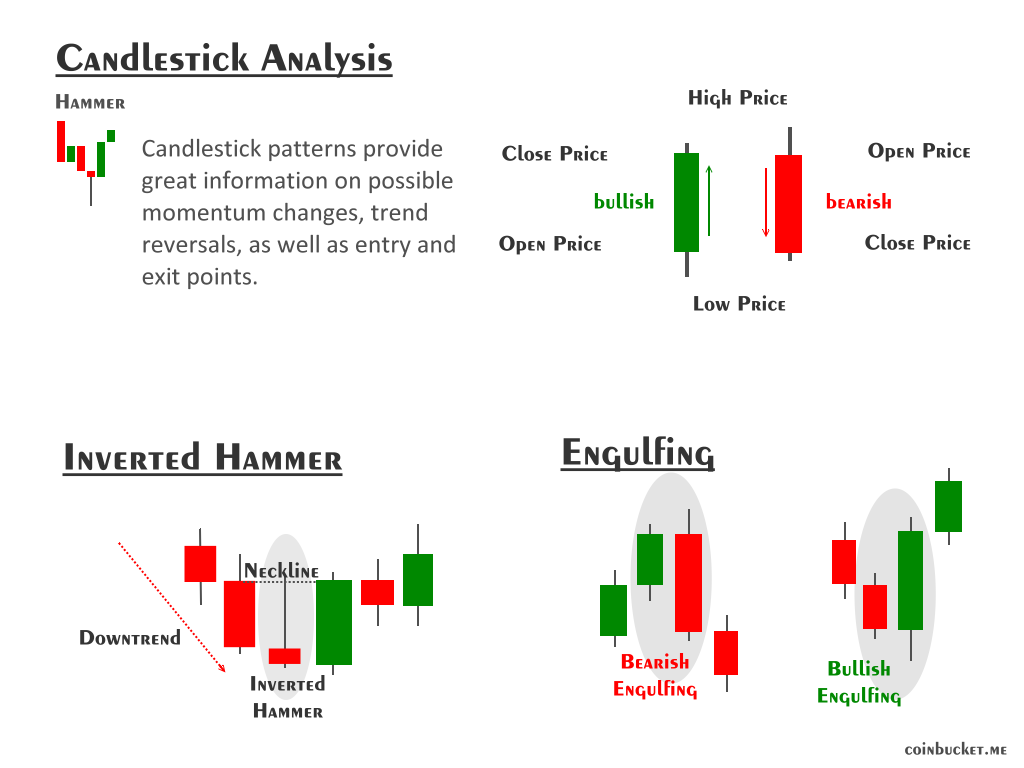

Getting started with Candlesticks: Spot High-Probability Setups and Dodge the Traps

Chasing those trends and momentum swings like the rest of us? Candlesticks…

Unlock Time-Saving DIY Trading Routines

$3.95? Why not $39.50? We do not embellish our basic offerings with frills or fancy extras to keep you mesmerized. The Plus entry-level package is fully functional, yet basic by design. Get access for a one-time contribution, not an arm and a leg.

But if you think that you can handle the full brunt of proprietary stock rankings, ambiguous recommendations, and recurring subscription fees, by all means sign up with Investor’s Business Daily (IBD).