2,826 words, 15 minutes read time.

Are the varieties of buy and sell orders too confusing? Too jargon-rich a nomenclature? Multiple cases to place orders? In any case, order types need to be better understood by novice traders. Do not put your money into the stock market without understanding the basics of some order types, especially the stop-loss order.

Intro

We already talked about screening stocks to find the most promising candidates for investment and/or trading. Then there is the issue of when to buy and when to sell shares in a stock. This post on order types addresses how to buy and sell shares in a stock.

Different order types can result in vastly different outcomes, also depending on market conditions. It’s important to understand these distinctions. We need to talk about three main order types—market orders, limit orders, and stop orders—and discuss how they differ and when to consider each.

It helps to think of each order type as a distinct tool suited to its own purpose. Whether traders are buying or selling, it is essential to identify their primary goal— whether it’s:

- having an order filled quickly at the prevailing market price (use market orders),

- controlling the price of a trade as best as possible (use limit orders),

- protecting a position from stock crashes (use stop orders).

Then, traders can determine which order type is most appropriate to achieve their goal.

The good news is that on most trading platforms, the basic order types operate alike. Order types of the same name are used to either buy or sell shares of stock.

For both buy and sell action, these are the basic order types:

- Market Order (explained at Schwab, Robinhood)

- Limit Order (explained at Schwab, Robinhood)

- Stop Market Order (explained at Schwab, Robinhood)

- Stop Limit Order (explained at Schwab, Robinhood)

- Trailing Stop Order (explained at Schwab, Robinhood)

Some trading platforms also offer advanced orders. Check at the platforms. Explanations of advanced order type options (Bracket, OCO, etc.) are beyond the scope of this post.

Here now is a concise rundown of basic order types for buying and selling in most ordinary situations.

Market and Limit Order Types

Market orders are the simplest order type used to buy or sell stocks for immediate fill executions. Limit orders are the preferred order type for high-risk/reward day traders. While we are not day traders, we may utilize limit orders as well.

🪶Market Order Types (2)

Best for:

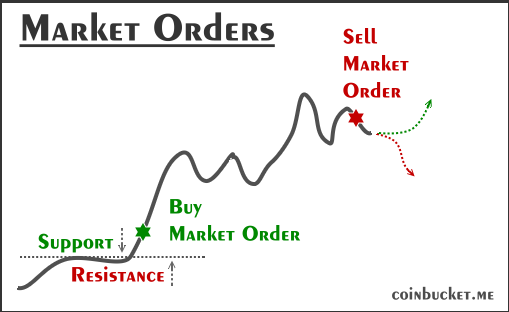

A market order may be appropriate when a trader wants to buy or sell a stock at the market’s best available price. It typically ensures immediate execution, but doesn’t guarantee a specific price. When the primary goal is to execute the trade immediately, a market order is optimal.

How it works:

A market order is an instruction to buy or sell a security immediately at the best available price in the market. There is no need to set a preferred price. This type of order prioritizes speed and execution over price precision, making it ideal for high liquidity stocks with minimal bid-ask spreads.

Buy Example:

Suppose a stock is trading at $550, and a trader believes it will go up, so s/he places a market order to buy 100 shares. The order will execute as soon as possible, but perhaps at different price points – as in 40 shares at $550.20, another 35 shares at $550.40, and the remaining 25 shares at $550.60. This variation occurs because the order fills according to available sell orders in the market.

Sell Example:

Suppose that the stock is now trading at $850, and the trader believes that the stock might soon drop. S/he places a market order to sell 100 shares to take profits. The order will be executed as soon as possible, but perhaps at slightly different price points.

💦Limit Order Types (2)

Limit orders may be appropriate when a trader thinks s/he can buy at a price lower than or sell at a price higher than the current quote. Limit orders guarantee a price but not when or if the order will be filled. Limit orders are not a substitute for stop orders!

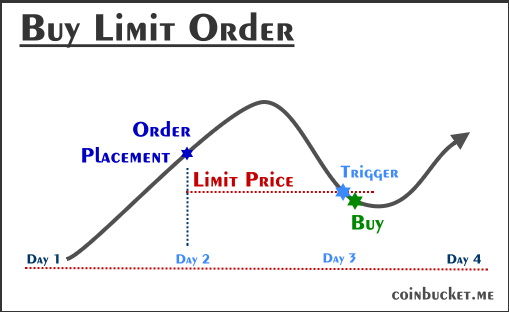

Buy Limit Order

Best for:

The trader intuits that s/he can probably soon buy shares in the stock at a lower price and save some money.

A buy limit order is placed at or below the current market price, and a buy will be executed as soon as the market price drops to the limit price or lower.

Example:

Suppose a stock currently trades at $80, but is possibly overvalued. A trader may then set a buy limit order at $80 to buy 20 shares at a limit price of $75. The order will only execute when the stock price falls to $75 or lower, indicating that sellers are then willing to accept that price or less.

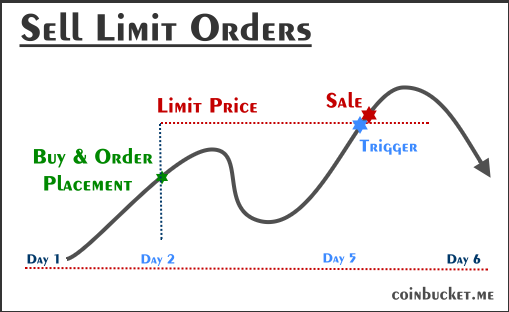

Sell Limit Order

Best for:

The trader aims to sell and take profits when the market price rises to a favorable level, such as a resistance point.

For a sell limit order, the trader obviously needs to own some shares of the stock. A sell limit order is placed at or above the current market price, and a sale will be executed when the market price reaches the limit price or higher.

Example:

The trader places a limit sell order at, say, $90, with a limit price at $95. The order will only execute when the stock price increases to the limit price of $95 or higher, indicating that buyers are willing to pay that price or more. If the market price never reaches the limit price, the limit order will not be filled.

As a trader thinking of selling, do not confuse a sell limit order (primarily for capturing gains) with a stop market or stop limit order (for preventing losses).

Stop Market & Stop Limit Order Types

A stop order is an order to buy or sell a stock at the market price once the stock has traded at or through a specified price (the “stop price”). There are two parts to a stop order: the initial stop price trigger activates a market or limit price order to sell or buy stock at the next available market price. If the stock fails to reach the stop price, the order is not executed.

TIP

Avoid setting sell stops too tight, as this can trigger premature exits during normal market fluctuations.

💢Buy Stop Order Types (2)

Buy stop orders come in two varieties: the buy stop market order and the buy stop limit order.

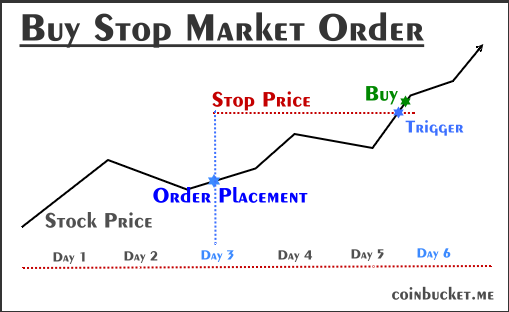

Buy Stop Market Order

Best for:

Stop orders are a trader’s safety net for automating buys without staring at screens all day. It is typically used to enter a long position when a breakout above a resistance level is anticipated. Since it turns into a market order upon activation, there is no guarantee of the execution price, and slippage may occur.

How it works:

The stop price of a buy stop market order is placed above the current market price. When the price rises to or above the specified stop price, the order automatically becomes a market order and executes at the next available price.

There is no other condition, such as a limit price, and no reason for a trigger to change the order.

Example:

A stock is trading at $50. The trader places a buy stop market order with a stop price of $55.

Once the market price jumps to $55.10, the order triggers and buys at ~$55.10 or whatever the market offers next.

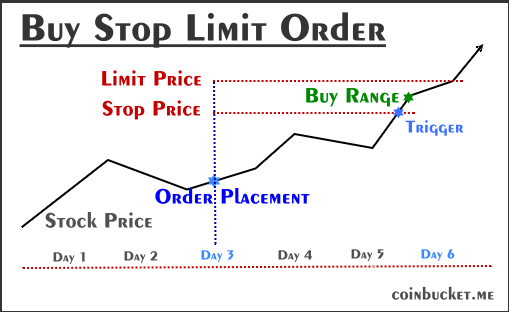

Buy Stop Limit Order

Best for:

This provides price control and protection against unfavorable fills at a runaway or even gaping-up price, but execution is not guaranteed. If the price does not reach the stop price or exceeds the limit price too quickly, the order remains unfilled.

How it works:

The stop price of a buy stop limit order is placed above the current market price. A limit price is placed above the stop price as an additional condition.

When the market price rises to the stop price, the event triggers the stop limit order to convert into a limit order, which will only be executed in the range between the stop price and the limit price.

Example:

A stock is trading at $50. The trader places a stop price $55, and sets a limit price of $55.50.

Once the market price runs to $55 and the next bids are around ~$55.20 to ~$55.40, the order fills at perhaps ~$55.40 (or better).

If the market price spikes to $56 instantly, the order expires unfilled. (A trader can set it to “good ’til canceled” to keep trying.)

Bottom line

Traders use buy stop market orders if speed trumps price (e.g., chasing a hot tip), and stop limit orders if missing a trade is acceptable to avoid overpaying.

🍂Sell Stop Order Types (2)

Sell stop orders come in two varieties: the sell stop market order (stop-loss order) and the sell stop limit order.

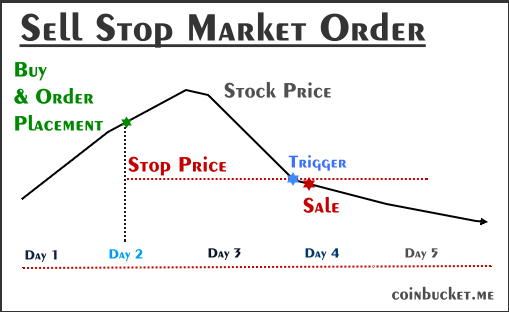

Sell Stop Market Order (STOP-LOSS ORDER)

Best for:

A sell stop market order is akin to an EMERGENCY EJECT BUTTON and ideal for a quick exit, regardless of the exact price. As a quick line of defense, they’re set to sell below the current buy price. Stop orders are a trader’s safety net for automating sells without staring at screens all day. After the market price advances, most traders then prefer to replace sell stop orders with sell trailing stop orders.

How it works:

The sell stop market order, also called a stop-loss order, should be promptly placed after purchasing the stock, and set below the buy price.

When the price declines or gaps down and eventually hits or passes the stop price, the sell stop market order automatically converts to a sell market order and immediately sells at the next available price (fast, but the price could slip significantly with volatility).

In the event of a rare flash crash, the sale might happen at fire-sale prices, resulting in significant losses.

Example:

The trader bought stock at $100 while the market was in an uptrend. The trader promptly sets a sell stop market order with a stop price of $95, which is below the buy and current market price, to protect the position from losses due to a decline or gap down.

When the market price drops to the $95 stop price or below, the stop market order converts to a market order, selling the stock immediately at $94.50 or the next available price, resulting in a small loss.

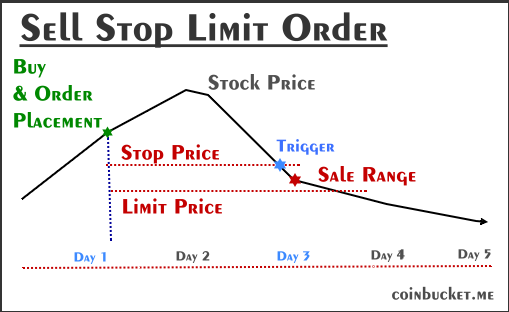

Sell Stop Limit Order

Best for:

The sell stop limit is like adding brakes to your emergency eject button. It’s all about protecting profits (or capping losses) when a trader thinks the stock might dip, but s/he does not want to dump it at fire-sale prices in a flash crash. Basically, it’s a stop loss with a price floor: sells below the current market, but only if the trader can get the sale at least at that specified limit price.

How it works:

With a sell stop limit order, a stop price is placed below the current market price, and a limit price is placed below the stop price.

When the stop price is reached, the event triggers the stop limit order to convert to a limit order instead of a market order. The limit order will only sell at the specified limit price or better.

This provides price control and protection against unfavorable fills, but execution is not guaranteed. If the market does not reach the stop price or moves past the limit price quickly, the order remains unfilled.

Otherwise, the sell does not execute and the trader is saddled with the declining stock for better or worse.

Example:

If a stock is trading at $50, a trader might set a stop price at $45 and a limit price below at $44 (as a minimum acceptable price).

If the stock’s price drops to $45, the sell limit order converts to a limit order, but will only execute if the stock can

Bottom line

Use sell stop market orders if speed trumps price (e.g., avoiding sudden downturns), and sell stop limit orders if an eventual rebound can soon be anticipated.

Missed placing an Emergency Stop Order?

As a trader thinking of selling, do not confuse a sell limit order (primarily for capturing gains) with a stop market or stop limit order (for preventing losses).

If the trader missed setting a stop order, such as a stop market order (stop-loss order), after buying a stock, and the momentum flips, leading to an accelerating decline in the stock price, it is best to consider issuing a quick sell market order to exit the losing trade immediately.

If a trader missed setting a stop order and the market price rises, s/he could place a sell trailing stop order instead.

Trailing Stop Order Types (2)

For trend and momentum traders, trailing stop orders are heaven-sent, so to speak. There is then no need to micromanage price action, as traders do not have to stare at their computer screens or phones every hour or two to check on their investments, as long as the trend (up or down) persists.

Trailing stop orders come in two varieties: the buy trailing stop order and the sell trailing stop order.

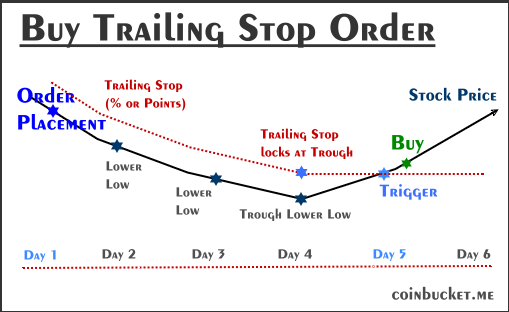

💥Buy Trailing Stop Order

Best for:

Perfect for riding downtrends while capping upside. This way, it protects from opportunity losses without a trader having to micromanage price action.

What is the opportunity loss or cost? Without a buy trailing stop order, the trader might miss taking a position early on in a burgeoning uptrend.

How it works:

The stock’s market price is in a significant downtrend. The buy trailing stop order “trails” the stock’s lowest price to the trough reached so far during the holding period. It adjusts downward automatically as the price falls (e.g., always staying x% or points above the current low), but it locks in place once the price starts rising again—never moving higher.

Once the current market price increases again and hits the locked trailing stop price, the order converts to a market order and is executed.

Example:

Downturns will eventually reverse, and market prices will trend up again. A trader is watching the market price as it seems to drop, let’s say, past $80, and believes that the price will soon find support at $60, a significant support level. The trader places a buy trailing stop order at $80 with a trailing stop of 5% or equivalent in points.

When and if the price action reverses at $60, a buy market order is executed as soon as the price hits $63, which is about 5% above the trough of $60. The trader has not wasted any time in catching onto new, positive momentum.

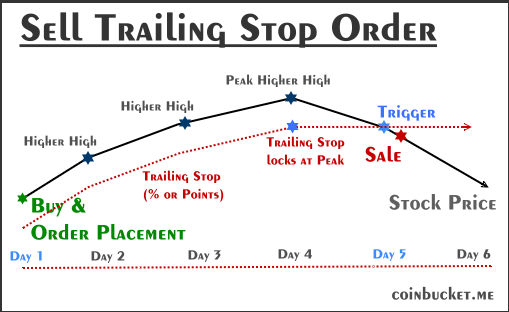

🙏Sell Trailing Stop Order

Best for:

Perfect for profitably riding uptrends while capping downside. Traders most often use it as part of an exit strategy. The sell trailing stop order protects real gains without a trader having to micromanage price action.

How it works:

A trader holds shares in a stock, and the market price is trending higher. A sell trailing stop order “trails” the stock’s highest price (to the peak) reached so far during the holding period. It adjusts upward automatically as the price rises (e.g., always staying x% or points below the current high), but it locks in place once the price starts falling—never moving lower.

Once the current market price declines and hits the locked trailing stop price, the order converts to a market order and is executed.

Example:

Uptrends will eventually reverse, and market prices will trend down in perhaps a correction. A trader is watching the market price rise, let’s say, past his or her buy point of $50, and believes that the price will soon hit $80, a significant resistance level. The trader places a sell trailing stop order at $60 with a trailing stop of 5% or equivalent in points.

When and if the price action reverses at $80, a sell market order is executed as soon as the price hits $76, which is about 5% below the peak of $80. The trader has not wasted any time in taking profits.

With these order types under your ‘mental belt’, you are now better equipped to enter the market. Take a look at our 2 dead-simple algos to fill your coin bucket. And add considerations of chart patterns to the mix for spotting high-probability setups.