451 words, 2 minutes read time.

We’ve been zeroing in on three nuts-and-bolts algos that actually help generate profits without turning you into a code wizard overnight. The sweet spot for uncomplicated winning boils down to one AI trick and a couple of classics: trend-following and mean reversion.

The AI trick is simple, but profound. You do not need to be a hacker, and you do not need to write a line of code at all. But you will need to write a line of words.

First, the two classics. They aren’t get-rich-quick fireworks, but they’ve got solid edges in trending and volatile markets like we’re seeing now: consistent 8-15% annualized returns in backtests on S&P stocks, with drawdowns under 10% if you size right. Here we spell out two of the better performers. They can be had manually with a bit of day-to-day attention on any better trading platform. Just add the indicators to the chart, say, on TradingView. But if you dare, they are also easy to code in Python or even no-code on platforms like Trade Ideas.

1. Moving Average Crossover Algo

This one’s the algo for riding waves without guessing tops/bottoms. It sniffs out momentum shifts by comparing short- and long-term averages—buy when the fast line crosses above the slow one, sell the flip. Dead simple, works great on liquid stocks/ETFs like TSLA or QQQ in uptrends.

The Rules (Daily Timeframe):

- Use a 50-day Simple Moving Average (SMA) for the “fast” line and 200-day SMA for the “slow” one.

- Entry (Long Only): When 50-day SMA crosses above 200-day SMA, buy at next open.

- Exit: When 50-day crosses below 200-day, sell at next open. (Or add a trailing stop at 5-10% below entry for protection.)

- Risk: Position size to 1-2% of your account per trade; skip if volume’s low.

Why It Works: Backtests from 2020-2025 show it nailing 12% avg annual returns vs. buy-and-hold’s 9%, with fewer whipsaws in bull runs. Low maintenance—runs on autopilot.

Watch Out: Doesn’t work well in sideways chop (false signals galore), so pair it with a trend filter like ADX >25.

2. RSI Mean Reversion Algo

Perfect algo for range-bound stuff—buys oversold dips and sells overbought pops, betting prices snap back to “normal.” RSI (Relative Strength Index) measures if a stock is stretched too far; it is uncomplicated math, huge for volatile names like TSLA.

The Rules (Daily Timeframe):

- Calculate 14-period RSI (standard default—over 70 = overbought, under 30 = oversold).

- Entry (Long): Buy when RSI drops below 30 and price is above 200-day SMA (to avoid downtrends).

- Exit: Sell when RSI hits 70, or after 5-10 days/5% gain—whichever first. (Short the inverse for bears if you’re feeling spicy.)

- Risk: Same 1-2% sizing; use a hard stop at 3-5% below entry.

Why It Performs: 2025 sims clock it at 10-14% returns on tech stocks, crushing in corrections (like that mini-dip in Q3). Remember, fewer trades mean lower fees.

Watch Out: Fails hard in strong trends (keeps you sidelined or fighting the tape), so confirm with volume spikes.

These two cover 80% of market moods without fancy AI—mix ’em for diversification. Also, add considerations of chart patterns for spotting high-probability setups to the mix. And don’t forget to place a stop-loss order under your investments to keep your coin bucket filled.

3. AI Chatbot Algo

It is October 29, 2025. You must have tried a chatbot by now, have you not? There we go. Now, OpenAI’s ChatGPT chatbot is immensely popular, and perhaps ahead of the game for many. But ChatGPT is not the only game in town. We have also been using Perplexity Pro for a while. That chatbot has one invaluable feature that its competitors for now still lack: a Task feature.

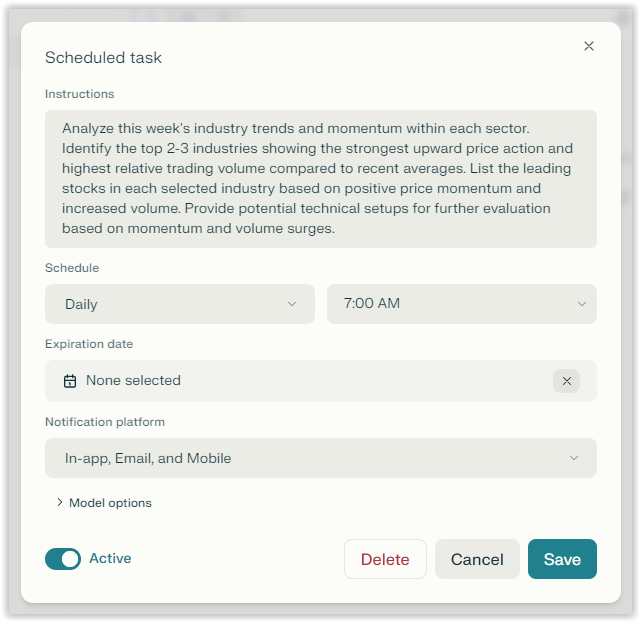

What does the Task feature accomplish? It allows me to schedule a task as a recurring action. Yep, we may find that feature in other chatbots sooner or later as well. But for now, it is Perplexity Pro. Let me explain.

Under Task, the chatbot lets me enter a specific prompt into its chatbox, then it asks for a schedule for when it should run the prompt and how to forward its answers. I can select whether the chatbot runs the prompt daily or weekly, and whether it returns its response to me by text message and/or email, and at what time.

And here is my prompt or instructions:

Can you see the benefit of this simple algo? Every morning, I now sit at my kitchen table, sipping my coffee and reading a free, well-informed, and concise article on the stock market that actually interests me.

I got Perplexity Pro free for a year via a promo. Otherwise, it will cost a little. But it may pay for itself over time.

Here is today’s summary response via email.

Perplexity Pro

| Healthcare sector breakout: Pharma and biotech stocks such as JNJ, ISRG, BIIB, and ABBV are showing strong price momentum and volume spikes, bolstered by positive earnings and technical setups like bullish flags and volume breakouts. |

| Healthcare sector breakout: Pharma and biotech stocks such as JNJ, ISRG, BIIB, and ABBV are showing strong price momentum and volume spikes, bolstered by upbeat earnings and technical setups like bullish flags and volume breakouts. |

| Industrials rebound sharply: Capital goods and robotics firms, including GM, CAT, HON, and CIFR, lead with robust price and volume action, strong technical bases, and accumulation spikes following positive earnings, providing potential buy triggers above prior resistance levels. |

The detailed response is more extended, thorough, and much more interesting:

https://www.perplexity.ai/search/analyze-this-week-s-industry-t-4Xo7komcQR.ZCqvE1mLLVQ

Should you try it for yourself? Your call. I make no money from Perplexity Pro, so there is no conflict of interest, no hidden agenda for me in promoting the chatbot.

Now, the prompt I wrote and entered into the chatbot can certainly be modified by you to suit YOUR interests. By all means, go ahead and refine the prompt. Create another task that is similar but distinct from this one, and have Preplexity Pro run it for you at your convenience as well.

Here is a suggestion. Create a prompt that emphasizes identifying young companies with transformative potential by focusing on key indicators such as technological innovation, market disruption, and scalability—critical traits shared by past market leaders.

These neat algo tricks make my days so much more productive. Let me know what they will do for you…